Last Updated on November 12, 2024 2:57 pm

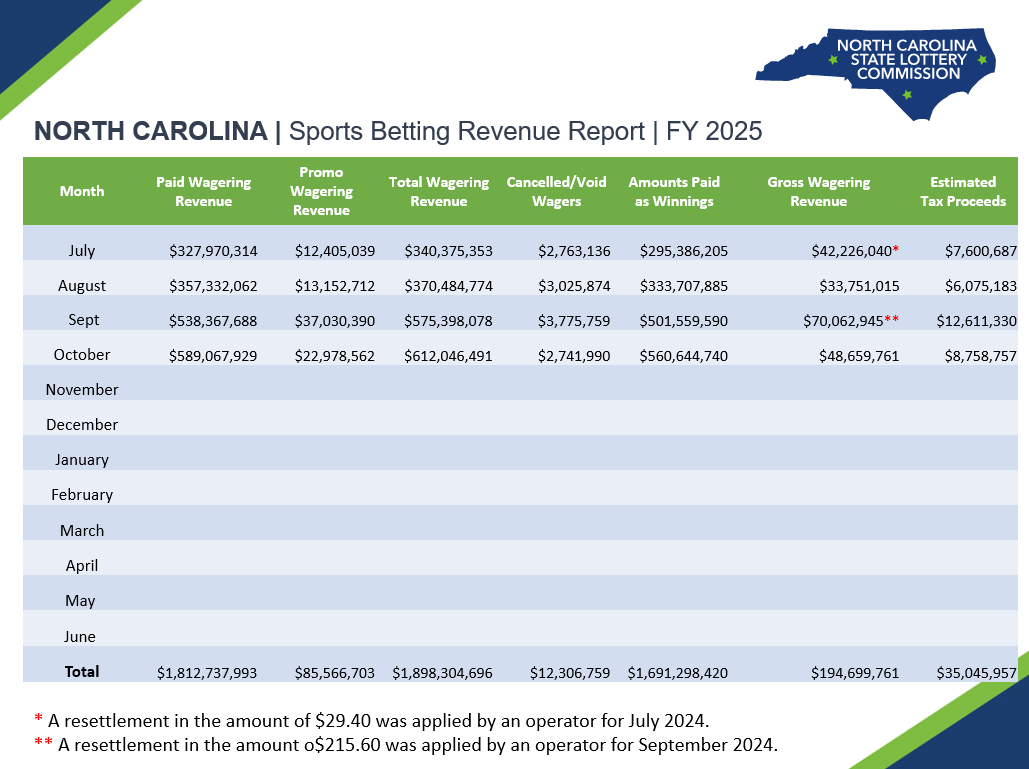

RALEIGH – The North Carolina State Lottery Commission is releasing its sports betting revenue report for October. It compiles the revenue in the month as submitted by the eight licensed interactive sports betting operators.

Between Oct. 1 and Oct. 31, account holders in North Carolina bet $612,046,491 on sports events, including paid and promotional bets. From those bets, account holders won $560,644,740.

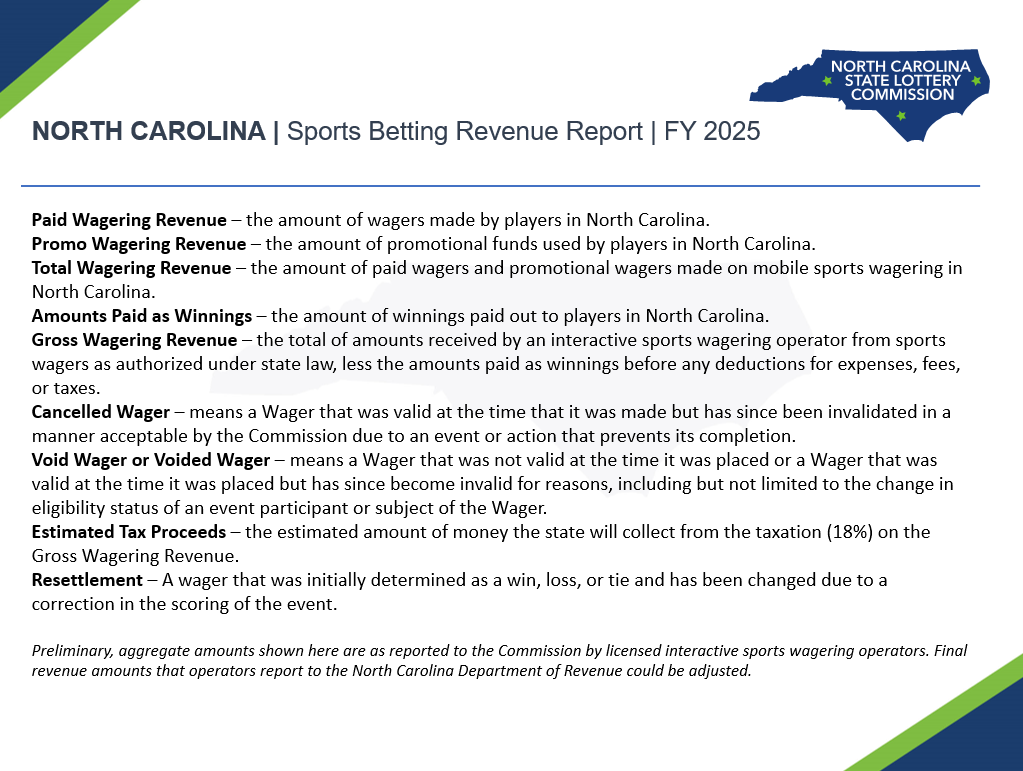

State law levies an 18 percent tax on the gross wagering revenue generated by sports betting activity. Gross wagering revenue is a total of amounts received from sports wagers less the amounts paid as winnings before any deductions for expenses, fees, or taxes.

In October, the gross wagering revenue was $48,659,761. After the 18 percent tax rate is applied, the estimated tax proceeds for the month would be $8,758,757. This is the money the N.C. Department of Revenue collects from sports betting.

Tax Rate:

State law places an 18% tax rate on the Gross Wagering Revenue of each interactive sports wagering operator. The North Carolina State Lottery Commission is responsible for the regulation of all sports wagering in the state of North Carolina. The N.C. Department of Revenue is responsible for collecting tax revenues from each licensed operator.

Use of Tax Proceeds:

The N.C. General Assembly, via N.C. Gen. Stat. §105-113.128, directed that the tax proceeds from gross sports wagering revenue will be allocated to benefit the state as follows:

- $2 million annually to the Department of Health and Human Services for gambling addiction education and treatment programs.

- $1 million annually to North Carolina Amateur Sports to expand opportunities in youth sports.

- Up to $300,000 annually to collegiate athletic departments at 13 state universities, including Appalachian State University, East Carolina University, Elizabeth City State University, Fayetteville State University, N.C. Agricultural & Technical State University, N.C. Central University, University of North Carolina at Asheville, University of North Carolina at Charlotte, University of North Carolina at Greensboro, University of North Carolina at Pembroke, University of North Carolina at Wilmington, Western Carolina University, and Winston-Salem State University.

- $1 million annually to the North Carolina Youth Outdoor Engagement Commission for grants of up to $5,000 per team or group, per county, to help cover the cost of travel to in-state or out-of-state sporting events and grants of up to $25,000 to attract amateur state, regional, area, and national sporting events, tournaments, and programs.

- Certain reimbursements to the N.C. State Lottery Commission and the N.C. Department of Revenue for expenses incurred to implement and administer the new law.

Of any remaining proceeds:

- 20% will be distributed evenly among the 13 state universities to support collegiate athletic departments.

- 30% to a new North Carolina Major Events, Games, and Attractions Fund to foster job creation and investment in the state.

- 50% to the state’s General Fund.