Last Updated on August 16, 2022 1:34 pm

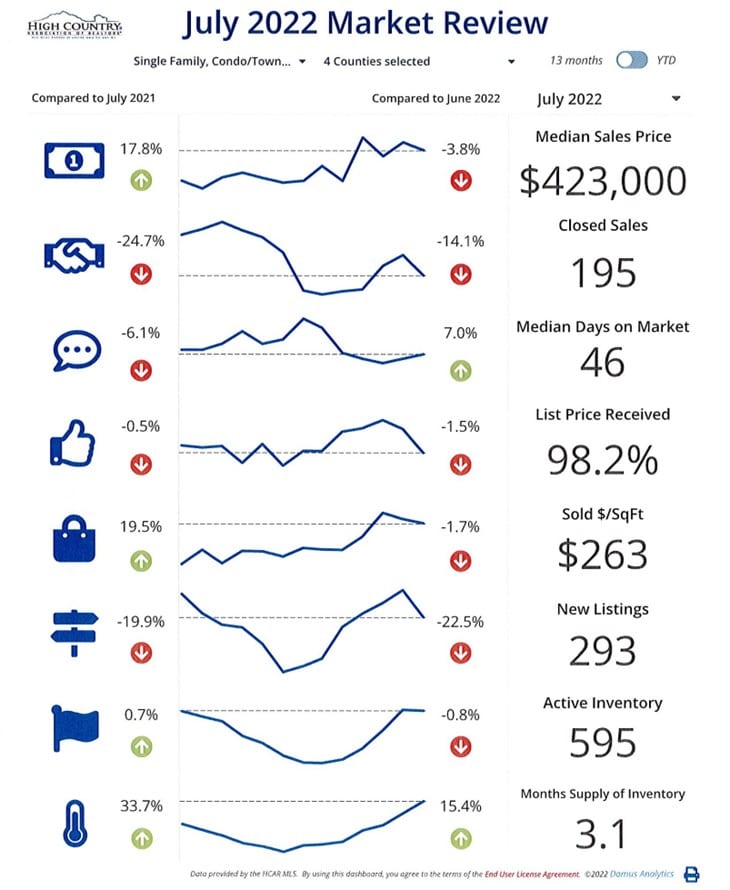

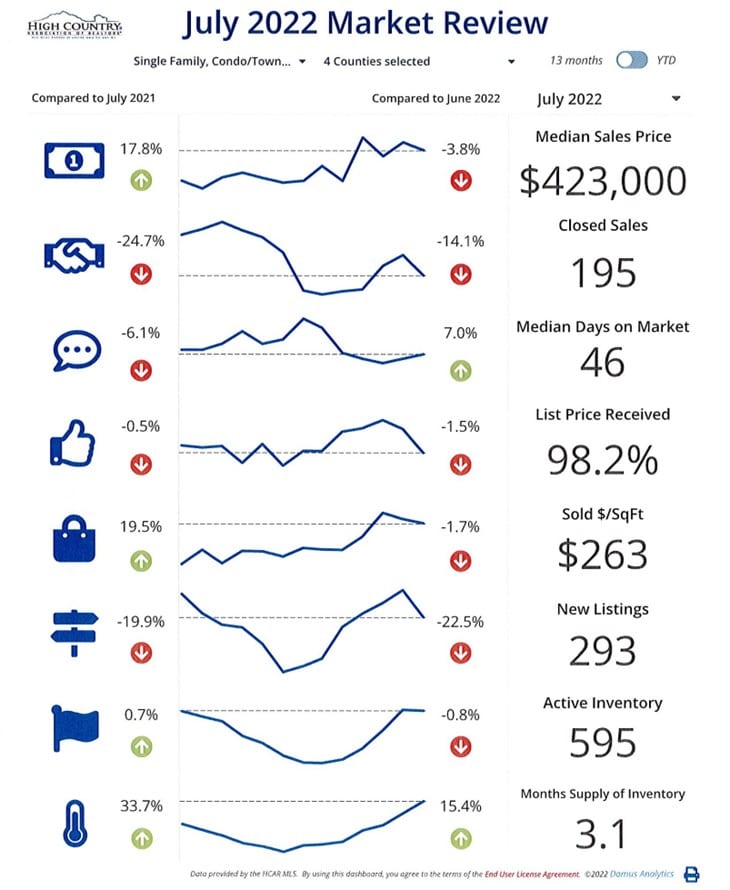

High Country Realtors® saw a subtle slowdown in July, compared to previous years. The High Country MLS reports that in July 224 homes were sold worth a combined total of over $119 million, 195 of those sold locally in Alleghany, Ashe, Avery, and Watauga counties contributing to $107 million of that recorded sales volume. This is a 14 percent decrease in closed sales, and a 6 percent increase in sales volume compared to July of last year when 260 homes sold for $ 114 million in the four-county district. The median sold price for residential homes in July of this year was $402,450, a 9.7 percent decrease versus July of 2021 ($445,858). Home affordability is on the rise caused by the typical effects of inflation, which the nation is currently battling. Mortgage rates continued to rise in July, along with home prices throughout our local area, and the nation. Freddie Mac’s chief economist, Sam Khater, explains that “although rates continue to fluctuate, recent data suggest that the housing market is stabilizing as it transitions from the surge of activity during the pandemic to a more balanced market. Declines in purchase demand continue to diminish while supply remains fairly tight across most markets. The consequence is that house prices likely will continue to rise, but at a slower pace for the rest of the summer.” Locally, sellers received an average of 98% of the list price in July and the median days on market was 46 days.

INVENTORY. MLS High Country counties, more specifically Alleghany, Ashe, Avery, and Watauga, reported 595 homes listed as active inventory for the month, which is 0.8 percent fewer properties than June of this year. JULY of last year actually saw 0.7% fewer homes on the market than JULY of this year. Alleghany reported 47 residential properties in inventory in July, a 6 percent decrease from the previous month. Ashe reported 108 residential properties in inventory, a 1.9 percent increase from June of this year. Avery reported 137 residential properties in inventory, a 6.8 percent decrease from last month. Watauga reported 303 properties in inventory during July, a 2 percent increase from the previous month.

ALLEGHANY COUNTY. REALTORS® sold 24 homes worth $8.38 million in JULY, an 7 percent decrease in total sales from July of 2021. The median sold price for JULY of this year was $286,080 – a 43 percent increase from JULY of last year ($199,450).

ASHE COUNTY. MLS reports that 42 homes sold worth $16.77 million in JULY, a 20 percent decrease in total sales compared to July of last year. The median sold price for the month of JULY was $390,850, a 40.7 percent increase versus JULY of 2021 ($277,705).

AVERY COUNTY. REALTORS® sold 37 homes worth $23.2 million in JULY, down 37 percent in total sales from a year ago. The median sold price this JULY was $465,000, a 27.4 percent increase over JULY of last year ($365,000).

WATAUGA COUNTY. There were 92 homes sold worth $59.18 million in JULY, a total sales decrease of 24 percent compared to last JULY. The median sold price this JULY was $472,500, an 8.4 percent increase over last JULY ($436,000).

LAND SALES. The MLS reported a total of 115 land listings sold in JUNE for a total of $12.1 million, this includes outside-area listings. There were 101 land listings sold exclusively in Alleghany, Ashe, Avery, and Watauga counties in JULY 2022, which totaled nearly $11.3 million. ALLEGHANY COUNTY: In July REALTORS® sold 12 land listings for $434,000. ASHE COUNTY Realtors® sold 30 properties totaling $2.4 million. AVERY COUNTY: Realtors® sold 16 land listings which totaled $1.6 million. WATAUGA COUNTY: Realtors® recorded 43 properties selling for $6.7 million.

COMMERCIAL SALES. In July there were 3 recorded commercial sales, in Ashe and Watauga counties, which totaled $2.8 million. The properties combined received an average 92 percent sale price to list price ratio.

INTEREST RATES. Rates recorded July 7th online via Freddie Mac reported the average 30-year fixed-rate mortgage loan was at 5.30 percent. At the close of the month, July 21st, rates were tracking at 5.54 percent. It appears the rates have dipped again as we see a 30-year fixed-rate mortgage currently being reported at 4.99 percent as of August 4th. The information posted online, per Freddie Mac, explains the cause of the fluctuation is “due to the tug of war between inflationary pressures and a clear slowdown in economic growth.”

Disclaimer: Figures are based on information from High Country Multiple Listing Service. Data is for informational purposes only and may not be completely accurate due to the MLS reporting processes. This data reflects a specific point in time and cannot be used in perpetuity due to the fluctuating nature of markets.

Report graphics generated from Domus Analytics pulled from the HCAR RETS feed. HCAR Realtor® members can access these detailed and customizable reports and graphics for professional use by logging into the HCAR dashboard – Info Hub and clicking on the Resources tab, then the HCAR stats link. A public graphic is available on our website homepage at highcountryrealtors.org.