Last Updated on January 23, 2024 10:37 am

MONDAY, JANUARY 22, 2024 – RALEIGH

North Carolina Commissioner of Insurance Mike Causey has issued the following statement to clear up any confusion regarding the recent filing made by insurance companies:

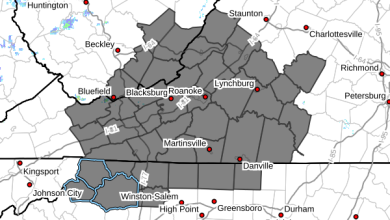

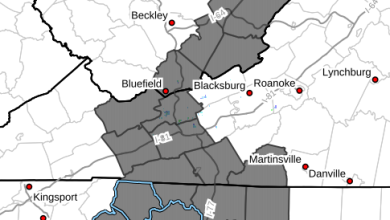

“Many North Carolina citizens have already told me how worried they are about the recent filing made by the N.C. Rate Bureau requesting an increase to homeowners’ insurance rates, and they’ve got good reason to be concerned. An average increase of 42% statewide, and as high as 99% for homes on the coast is a lot.

“But first let me be clear – the Commissioner of Insurance in North Carolina does not set insurance rates. The Rate Bureau is an organization created by the N.C. General Assembly. The Insurers in the State that write certain lines of personal insurance, including homeowners and automobile, are the members of the Rate Bureau. It is the Rate Bureau, and not the Commissioner of Insurance, that submits proposed insurance rates to the Department of Insurance for consideration.

“Under our laws, the Commissioner has 50 days from the filing date to review the Rate Bureau’s proposal to determine whether it meets certain very technical, mathematical standards. In addition, during this 50-day review period, the public may submit comments on the Rate Bureau’s proposal. Consumers can do so by submitting those comments in writing to us via mail or e-mail by February 2.

“I also scheduled a public comment forum that took place today as another way for the public to express their views, and some speakers at that forum said that I should have attended. But, the Rate Bureau has accused the Commissioner of Insurance in the past of prejudging a rate request before a notice of hearing may be issued. So, it is important that I not appear to have prejudged the request before our review is complete. However, I have heard the comments today and the countless comments submitted by our citizens, and I take them all very seriously.

“During this 50-day review period, which expires on February 22, the Department’s actuaries, attorneys and consultants are working tirelessly to determine whether the Rate Bureau’s proposed increase is “excessive, inadequate or unfairly discriminatory.

“If it is, I will call for a hearing on the matter and will fight for our consumers to ensure that any proposed increase is reasonable and actuarially sound. Since I have had the honor to serve as your Commissioner of Insurance, I have strived to ensure that any proposed increases to your insurance rates are fair, and I will continue to do so now and in the future. But, just to be clear, although the Rate Bureau submitted the requested increase, the request has not been approved.”

Consumers who have questions about their insurance can visit www.ncdoi.gov or call the department toll free at (855) 408-1212.