Last Updated on November 10, 2021 12:45 pm

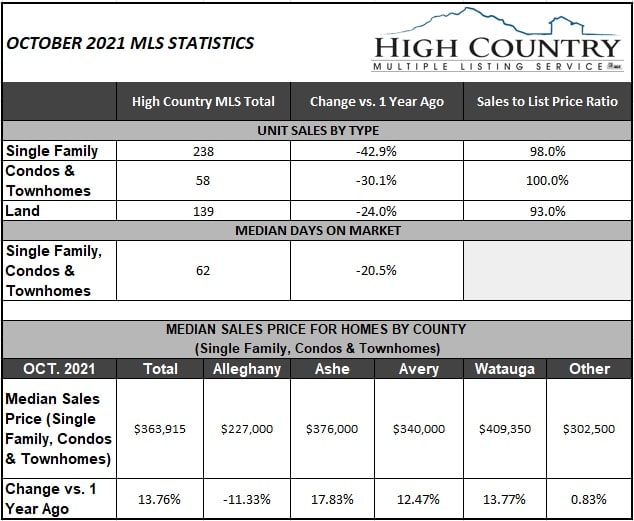

OCTOBER 2021 MLS REPORT: Realtors® in the High Country continue to diligently work to find properties for their clients while seeing another month of declining inventory. Local Realtor®, Billie Rogers explains “Home sales have definitely slowed due to a lack of inventory. (Land) lots are the sale now, as are fixer uppers”. But even with declining sales, the cost of our housing market continues to rise. To further emphasize buyer demand, High Country homes continue to sell for an average 99 percent of their original listing price.

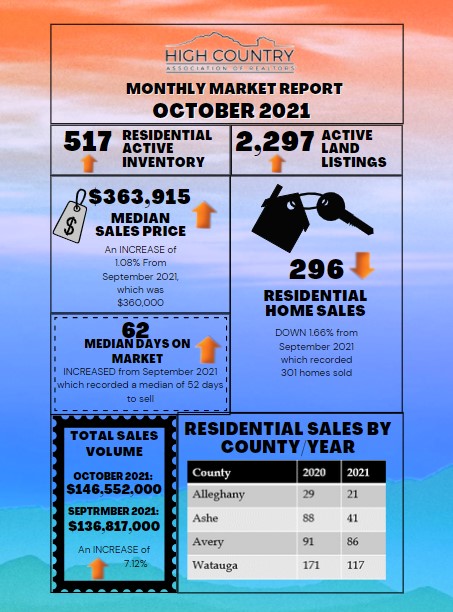

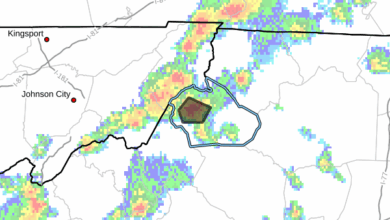

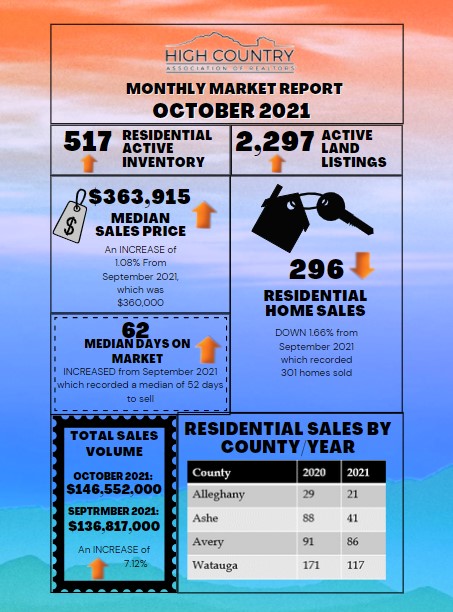

INVENTORY: The High Country MLS recorded 517 residential properties and 2,297 land listings active at the first of October. When compared to September which saw 504 active listings… October did have a slight uptick in active listings showing in the MLS the first of the month. However, current numbers show November listings dropping to 428 residential properties and 2,317 active land listings as of November 5th.

RESIDENTIAL: The High County MLS recorded 296 residential properties sold this October. This is a decrease compared to the 301 homes that were sold the previous month. Residential sales totaled $146,552,000 in October, which is an increase compared to $136,817,000 recorded in September. The median price of homes sold was recorded at $363,915, which is a slight increase compared to the $360,000 median the previous month. It is interesting to note that last October the MLS recorded 417 homes sold, $167,866,269 in total sales, and a median home price of $300,000.

ALLEGHANY COUNTY: October 2021 – Alleghany County Realtors® sold 21 homes for nearly $5.9 million. The median sold price for those properties was $227,000. Sold properties recorded October 2021 reduced slightly from the 24 homes sold in September. The total sold value came to over $ 5.8 million in September. The median sold price also increased this month compared to the $ 172,900 median recorded in September.

ASHE COUNTY: October 2021 – Ashe County Realtors® sold 41 residential properties totaling over $15.9 million. The median sold price was $376,000, which is an increase compared to the $320,500 median the previous month. Recorded homes sales declined compared to last month, which saw 58 homes sold. The total sold value, which was $18.6 million in September, also decreased for October.

AVERY COUNTY: October 2021 – Avery County Realtors® sold 86 homes which totaled over $47 million. The median sales price for those properties was $340,000. In September, Avery County Realtors® recorded 78 homes sold. September recorded less sold value total, which was $40 million. The median sold price in September was $305,608 a decrease compared to this month. There were 14 homes in Avery County that sold for over a million dollars during the month of October.

WATAUGA COUNTY: October 2021 – Watauga County Realtors® recorded 117 residential properties selling for over $66.4 million. The median sold price was $409,350, a decrease from the median $429,500 recorded the previous month. September saw 116 homes sell for $63.6 million. There were 28 homes sold for over a million dollars during the month of October in Watauga County.

LAND: High Country Realtors® sold 139 land listings in October 2021, which totaled in value over $17.7 million, we saw the same value total the previous month. However, October saw an increase in sold listings from the 132 land listing sales recorded in September. ALLEGHANY COUNTY: Realtors® sold 12 land listings for $574,000. ASHE COUNTY Realtors® sold 36 properties totaling over $3.2 million. AVERY COUNTY: Realtors® sold 27 land listings which totaled over $5.2 million. WATAUGA COUNTY: Realtors® recorded 51 properties selling for over $6.7 million.

COMMERCIAL: For the first time since July 2020, High Country Realtors® sold only 1 commercial property for the month. The property, located on Main Street in Blowing Rock, NC, totaled $970,000.

INTEREST RATES: Mortgage rates rose, topping out around 3.15% at the end of October. But after several weeks of increasing, we now see them drop slightly. Currently, 30-year fixed rate mortgages are back down to 3.09% as of November 4th, 2021. Freddie Mac still predicts mortgage rates to rise into the near future due to economic growth and the Federal Reserve rolling back pandemic era stimulus to fight inflation.

Disclaimer: Figures based on information from High Country Multiple Listing Service. Data is for informational purposes only and may not be completely accurate due to MLS reporting processes. This data reflects a specific point in time and cannot be used in perpetuity due to the fluctuating nature of markets.