Last Updated on February 12, 2022 6:42 pm

RALEIGH — The N.C. Department of Insurance has settled a homeowners' insurance legal dispute with the North Carolina Rate Bureau, averting a potentially costly administrative battle with insurance companies. This means the hearing scheduled for Oct. 2 is canceled.

In addition, Commissioner Mike Causey announced that the Department has also negotiated a settlement with the NCRB on mobile home insurance rates.

“I am happy to announce that North Carolina homeowners will save nearly $285 million a year in premium payments compared to what the NCRB had requested,” Commissioner Causey said. “I am also glad the Department of Insurance has avoided a lengthy administrative legal battle which could have cost consumers time and money.”

Homeowners' insurance

In 2018, the Rate Bureau, which represents companies writing property insurance in North Carolina and is not a part of the N.C. Department of Insurance, proposed a 17.4% statewide overall increase in homeowners' insurance rates. After studying the data, Commissioner Causey negotiated a settlement for a much smaller rate of an overall statewide increase of 4%.

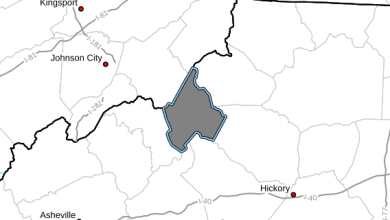

The 4% increase will vary according to territory, with a cap of 10% statewide instead of the 30% cap in some coastal territories initially requested by the NCRB. The highest negotiated rate increase is 9.8% in some coastal territories. The western-most territory in the state will see an average 0.1% decrease.

Compared to the rates requested by the NCRB, the settlement means a significant savings for homeowners. For example, Wilmington residents with a $200,000 frame home with a $1,000 deductible would pay an average $400 less a year than had the NCRB's requested rates gone into effect. Residents for similar homes in Wake and Durham counties would pay an average $120 less.

The increase will take effect on new and renewed policies beginning on or after May 1, 2020.

Homeowners Individual Territories and Rates

Mobile home insurance

In February, the NCRB requested an overall statewide average increase of 19% for MH-C (Casualty) policies and an overall statewide average increase of 19.9% for MH-F (Fire) policies. Both MH-C and MH-F programs provide property and liability coverage. The agreement reached between the Department of Insurance and the NCRB provides for an overall average increase of 4.3% for MH-C policies and an average overall statewide rate increase of 6.6% for MH-F policies.

Rates will vary according to territory.

Both mobile home insurance changes are effective for new and renewed policies written on or after May 1. 2020.