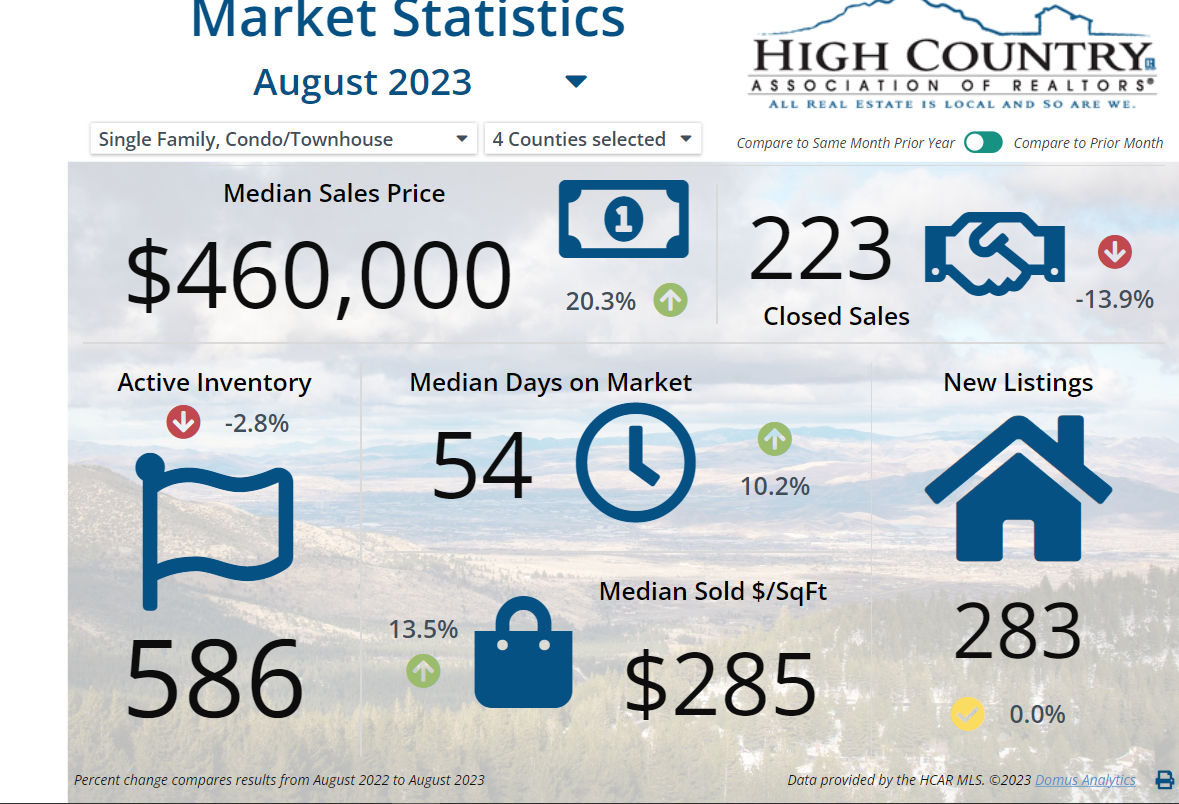

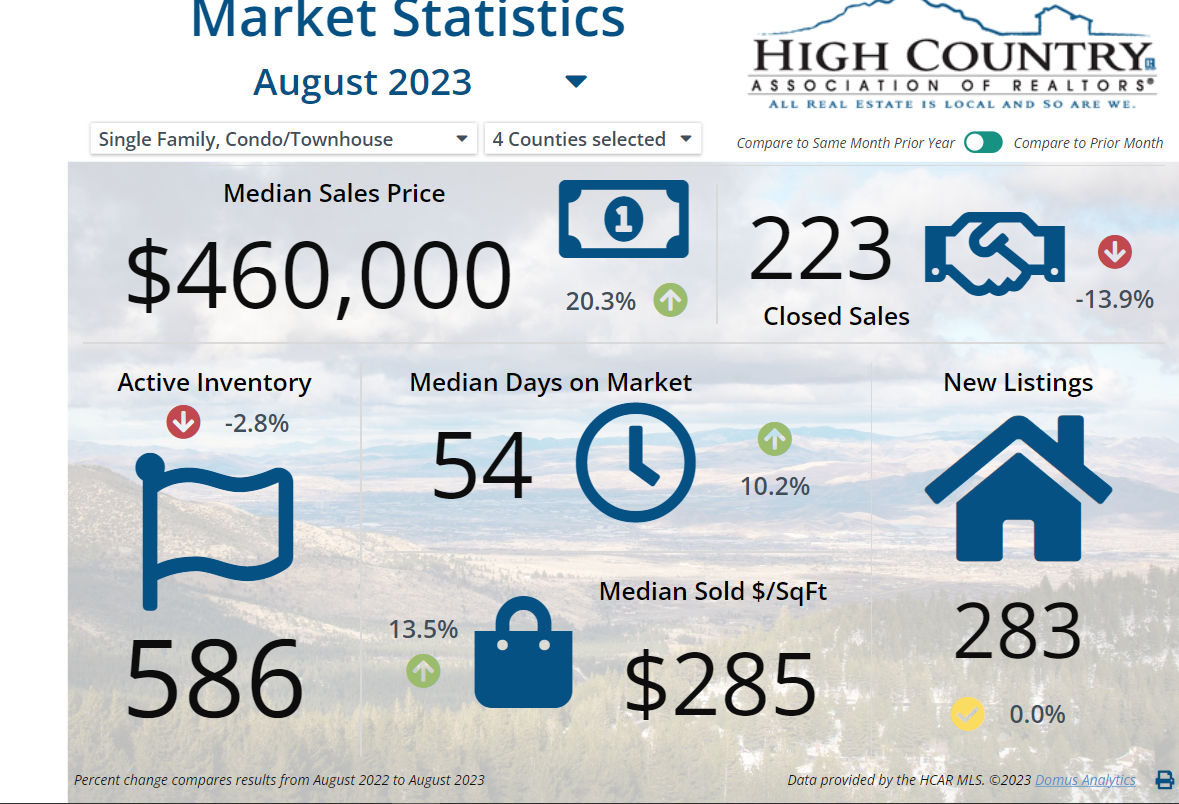

August in the High Country was a time of vacationing before heading back to school, especially with continued summer like temperatures. Fall is in the air and our High Country REALTORS® are preparing for the busy fall season of real estate. During August, our realtors brought 223 Residential Sales to the closing table for a combined total of over $125 million in sales. The combined median sales price in our four county area of Alleghany, Ashe, Avery, and Watauga Counties was $460,000 and the median days residential properties were staying on the market was 54 days.

INVENTORY: A recent report from Reatlor.com® mentions rising interest rates affecting homebuyers as mortgage payments are rising for homebuyer’s while many homeowners in lower rate mortgages are reluctant to give up those lower rate mortgages and are choosing to stay in their homes. Realtor.com® Chief Economist Danielle Hale, says “this is a key contributor to low housing inventory.” The High Country Markets inventory is low compared to prior years but still holding its own. In August we saw 283 new listings coming onto the MLS in the High Country bringing the total of Residential properties for sale in our market to 579 in active listings equating to a 2.6 month supply of inventory.

LAND: Our land inventory is similar in number to what our residential inventory used to be. We have over 1600 land listings active in our High Country Market. This equates to an 18.1 month supply of inventory. In August, our realtors closed on ninety-one land sales totaling $9.7 million in combined sales for our four counties.

COMMERCIAL: Currently reported in the High Country MLS are forty-four active commercial properties for sale. There were five sales in August for a combined total of over $3 million in sales.

Alleghany County: Realtors had seventeen closed sales on residential properties in the county during August for a combined amount of $6.5 million. The median sales price was $315,000 and the median days on the market was 62 days. Alleghany has forty-four residential properties active and a 2.9 month supply of inventory.

Ashe County: Realtors had forty-seven closed sales on residential properties in August with a combined amount of $19.8 million. The median sales price in the county was $400,000 and the median days on the market were 47 days. There are currently ninety-four residential properties and a 2.1 month supply of inventory in Ashe County.

Avery County: Realtors had sixty-one closings during the month on residential properties for a combined amount of $34.2 million. The median sales price was $391,000 and median days on the market was 70 days. The number of active residential properties in the county is 153 which is a 2.6 month supply of active inventory for the county.

WATAUGA County: Realtors had ninety-eight closed sales in the county on residential properties totaling $65.6 million in sales. The median came in at $547,500 and the median days on the market was 49 days. Currently there are 250 active residential properties in the county for sale equating to a 2.9 month supply of inventory.

INTEREST RATES: Jeff Reeves with Fairway Independent Mortgage recently quoted “despite higher interest rates, homebuyers are still actively home shopping. Conversations seem to show clients have accepted rates are up and are not expecting them to decrease anytime soon.”

“I am also seeing clients taking advantage of various down payment assistance programs. Two of these, the USDA Rural Development (USDA) and the North Carolina Housing Finance Agency (NCHFA) offer programs that can help qualified homebuyers purchase a home with little or no down payment.”

“The USDA's Single Family Housing Direct Home Loans program allows eligible borrowers to purchase a home with no down payment. The NCHFA's NC 1st Home Advantage Down Payment program provides eligible first-time homebuyers with up to $15,000 in down payment assistance.”

Disclaimer: Figures are based on information from High Country Multiple Listing Service. Data is for informational purposes only and may not be completely accurate due to MLS reporting processes. This data reflects a specific point in time and cannot be used in perpetuity due to the fluctuating nature of markets.

Report graphics generated from Domus Analytics pulled from the HCAR Web API feed. HCAR Realtor® members can access these detailed and customizable reports and graphics for professional use by logging into the HCAR dashboard – Info Hub. A public graphic is available on our website homepage at highcountryrealtors.org.